Here to serve the people of Montana and its livestock industry.

Centralized Services

- Current Per Capita Fees on Livestock

- Aerial Hunting Permits

- Employment Opportunities

- EEO Policy

- Contact Information

Agency Information

Contact Information

Department of Livestock

Centralized Services Division

PO BOX 202001

Helena, Montana 59620-2001

Email: livemail@mt.gov

Livestock Per Capita Fees

Per Capita Rates

| Cattle | $ 2.46 |

| Sheep and Goats | $ 0.58 |

| Horses and Mules | $ 6.27 |

| Swine | $ 0.84 |

| Poultry | $ 0.07 |

| Bees | $ 0.43 |

| Llamas and Alpacas | $ 10.42 |

| Bison | $ 4.66 |

| Domestic Ungulates (alternative livestock) |

$ 28.22 |

| Ratites | $ 10.42 |

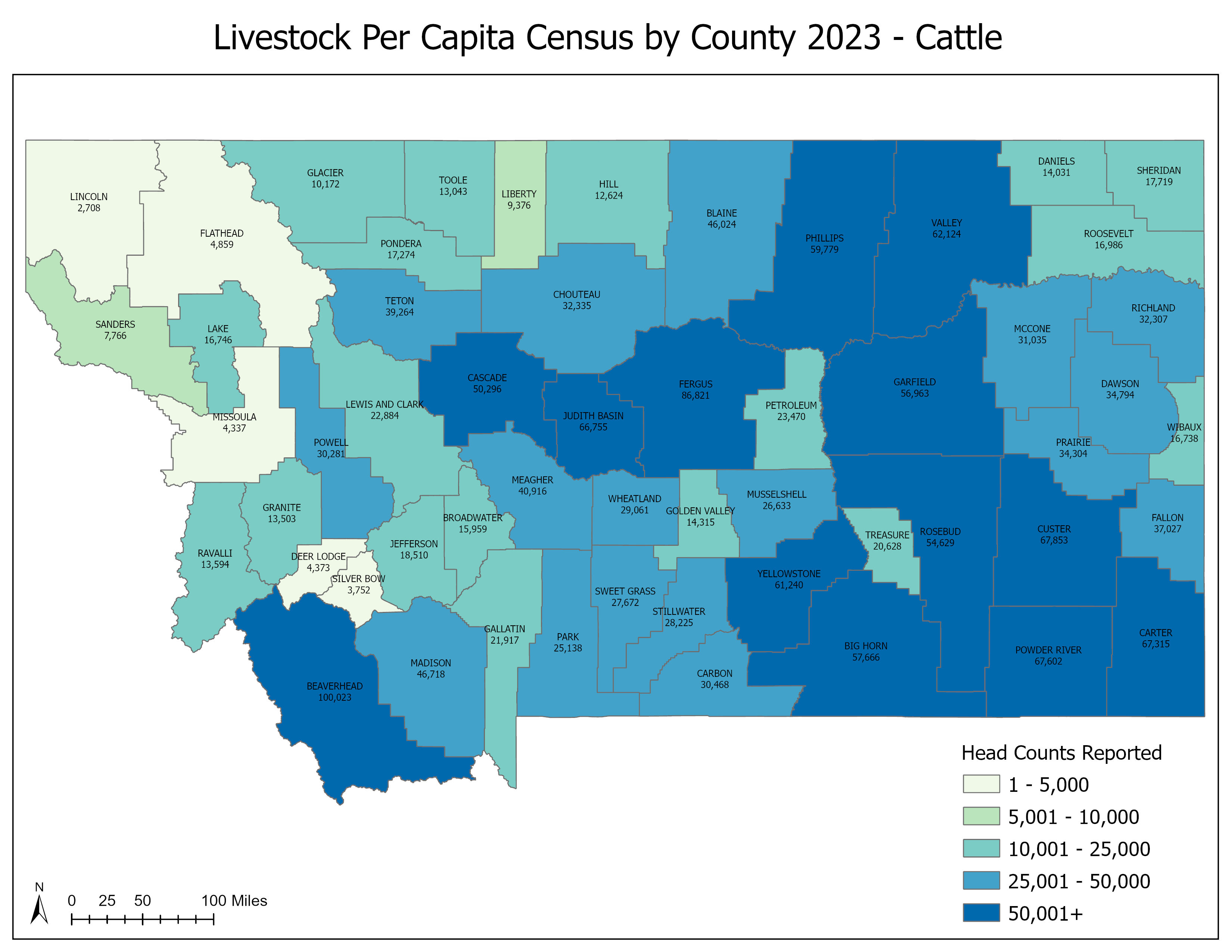

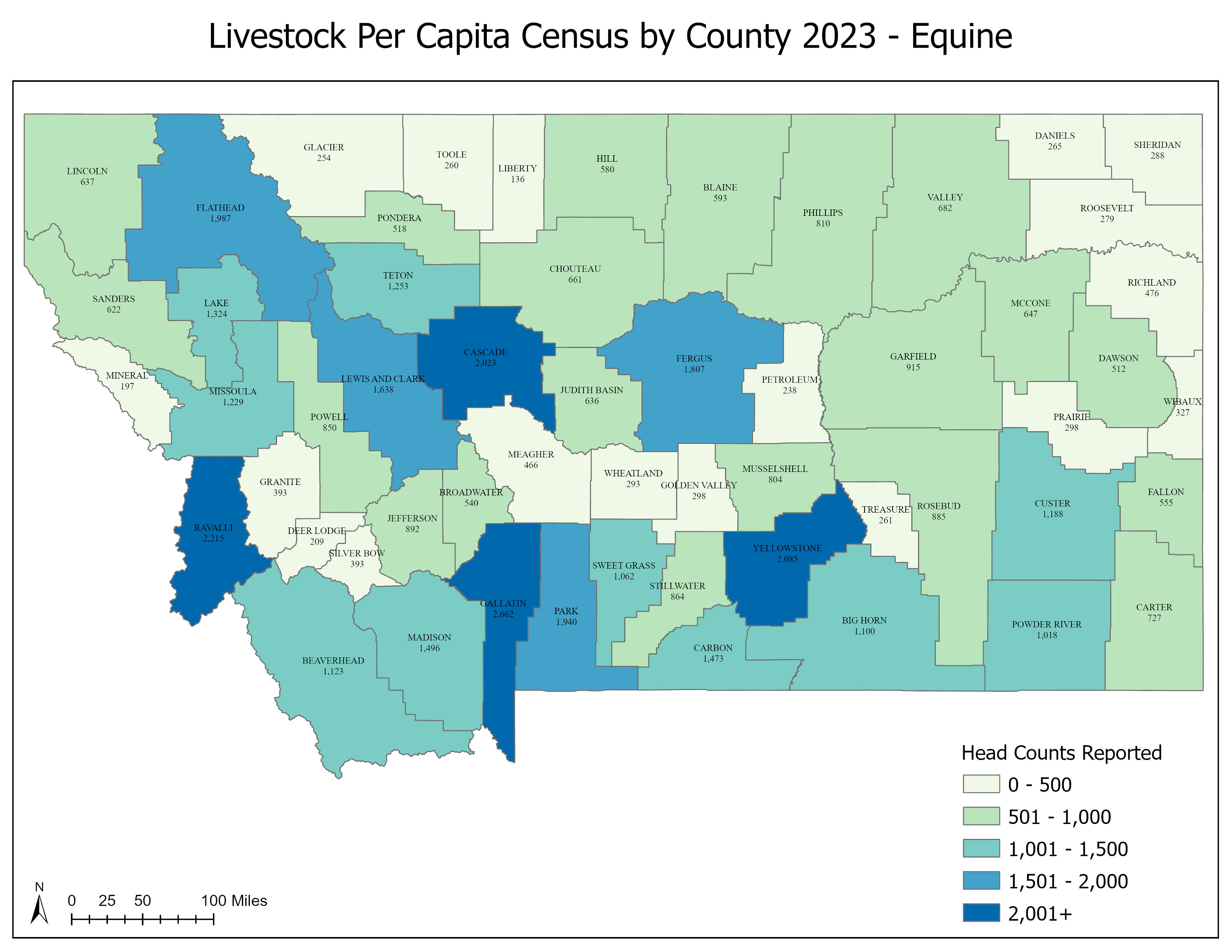

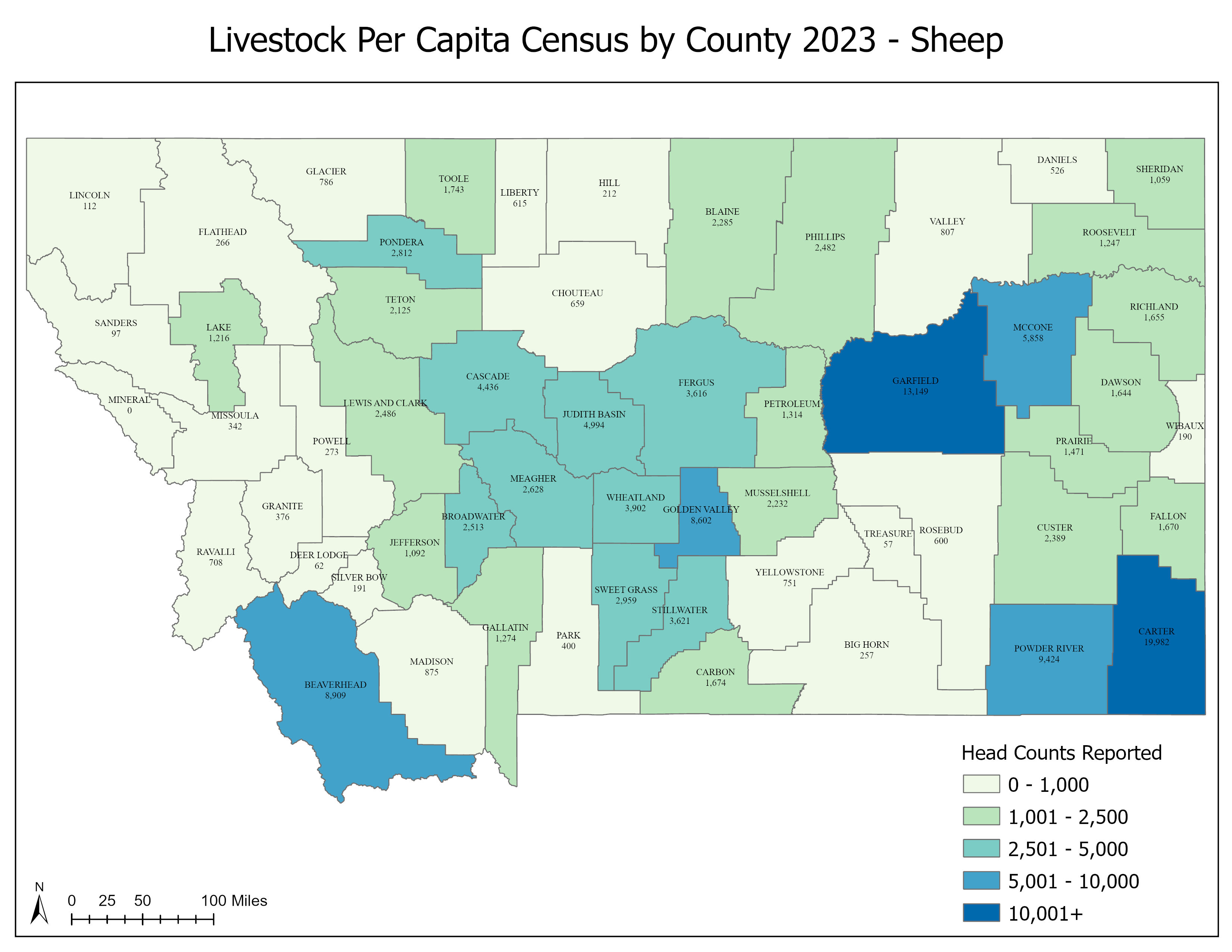

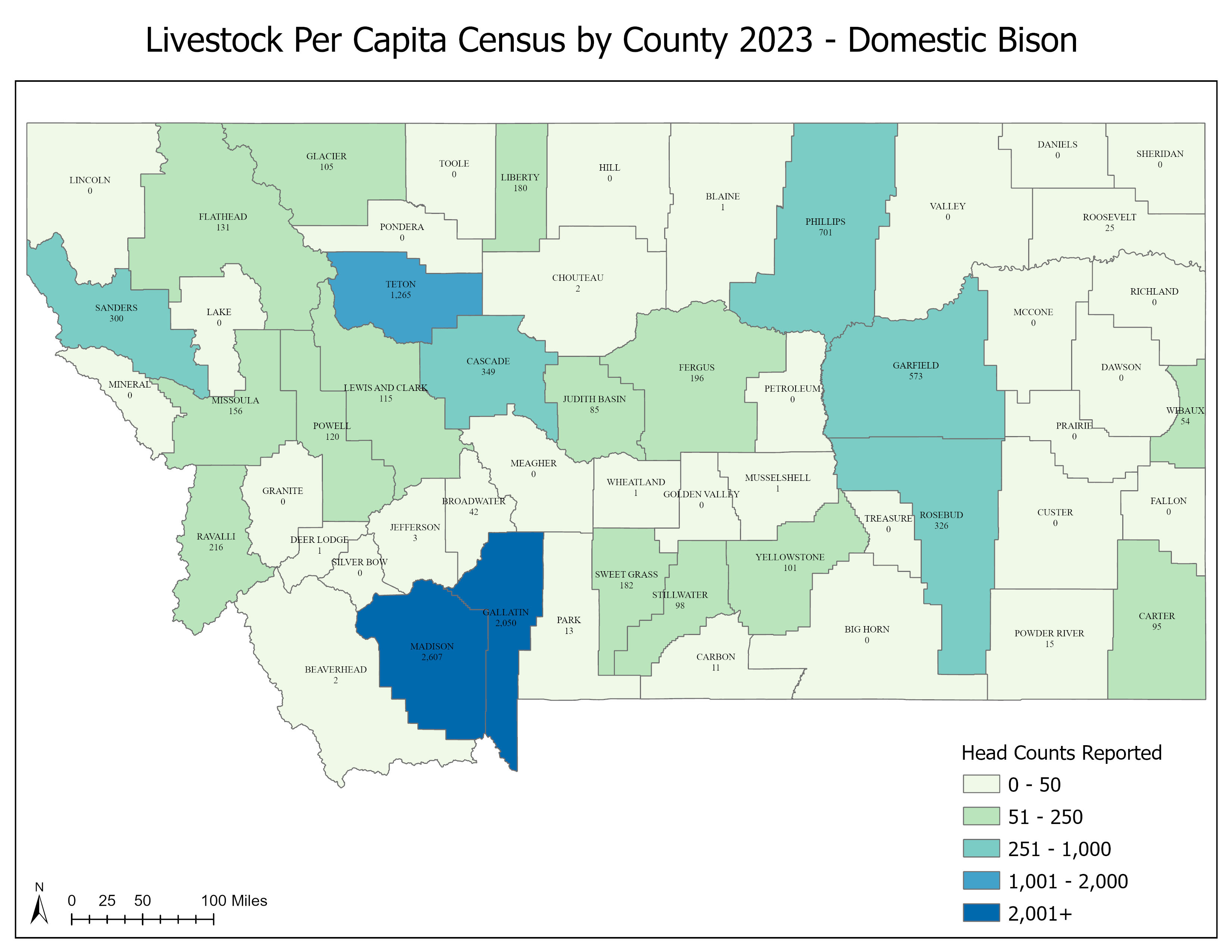

Livestock Per Capita Census Data - 2023

Click an image below to display a larger version of the map.

|

|

|

|

Per Capita Fee Information

- Per capita fee payments are due March 1.

- Livestock owners can report livestock and pay per capita fees at the same time.

There are two ways to report livestock:

- Report livestock online at Livestock Reporting and Per Capita Fee Payment

- Mail a completed livestock reporting form

For additional information visit the Department of Revenue website or call (406) 444-6900 or Montana Relay at 711 for hearing impaired.

What are per capita fees?

The Board of Livestock annually sets the livestock per capita fee rates. The Department of Revenue collects livestock numbers and per capita fees on behalf of the Department of Livestock.

Per capita fees are per-head fees charged on livestock. Authorized by Montana Code Annotated 15-24-921, per capita fees are assessed on "all poultry and honey bees, all swine three months of age or older, and all other livestock nine months of age or older." The fees help fund the department's animal health programs, brands enforcement, theft investigation and recovery, and predator control.

Per capita fees are user-generated, and are an important component of the department's budget. Other user-generated fees are derived from brand enforcement, lab testing and milk inspection fees. Overall, user-generated fees account for about three-quarters of the department's annual budget, with the remainder coming from state general fund and federal funds.

Per capita fees are unique in that livestock owners are responsible for "self-reporting" the number of livestock they own to the Department of Revenue, which bills and collects the fee for the Department of Livestock. Livestock owners must report the number of livestock owned on February 1 to the Department of Revenue. Even if you own just one horse and a few chickens, or owned and reported last year but no longer do, you still need to report. Report your livestock in the county where the livestock are located on February 1. The report and payment are due by March 1. If you do not pay by March 1, you will be billed on April 1. Penalty and interest will begin to accrue on March 2.

Everyone benefits from programs funded by per capita fees. Livestock producers benefit from programs to monitor animal health, monitor and restrict livestock imports, track animal movements, prevent and investigate livestock theft, and manage predators. The general public benefits from programs that prevent the spread of animal diseases to humans.

Refunds:

- 15-24-903 MCA - Duty of owner to assist in assessment.

- 15-24-921 MCA - Per capita fee to pay expenses of enforcing livestock laws.

- 15-24-922 MCA - Board of livestock to prescribe per capita fee - refunds.